CGG Announces its Q4 and Full Year 2020 Results

Paris, France | Mar 5, 2021

Q4 Solid Operational Performance

2021 Positive Net Cash Flow sustained by gradual recovery

CGG (ISIN: FR0013181864), a world leader in Geoscience, announced today its fourth quarter and full year 2020 audited results.

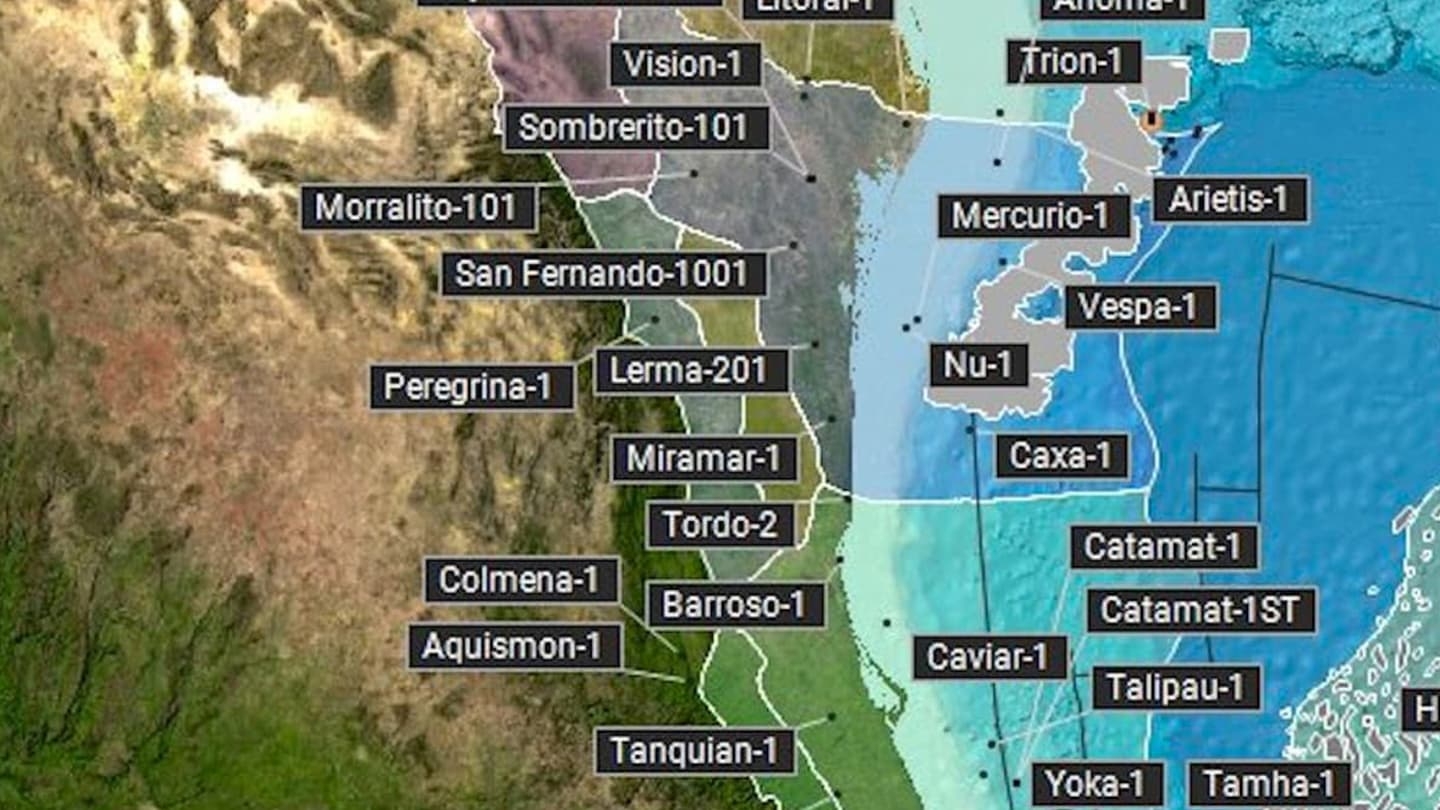

Commenting on these results, Sophie Zurquiyah, CGG CEO, said: "In the particularly challenging year of 2020, which saw the collapse of the oil & gas market across the second and third quarters, we finished the year with solid fourth quarter operational performance. During 2020, we successfully completed our exit from the Acquisition business while continuing to advance our high-end Geoscience technologies for reservoir development and production. We also delivered our Multi-client surveys in the industry’s core mature sedimentary basins and released new products while reinforcing our market leadership in Equipment. Our initiatives towards energy transition are accelerating with the development and commercialization of new business offerings, along with our announced target to achieve carbon neutrality by 2050. Looking forward, as global economies continue to progressively recover and with oil price stabilizing above $50/bbl, we expect CGG’s performance to benefit from the proactive cost reduction actions and gradually strengthen in the second half of the year, delivering positive net cash flow in 2021."

Q4 2020: Solid Operational Performance

- IFRS figures: revenue at $217m, EBITDAs at $52m, OPINC at $(58)m

- Segment revenue at $283m, up 42% quarter-on-quarter and down (29)% year-on-year

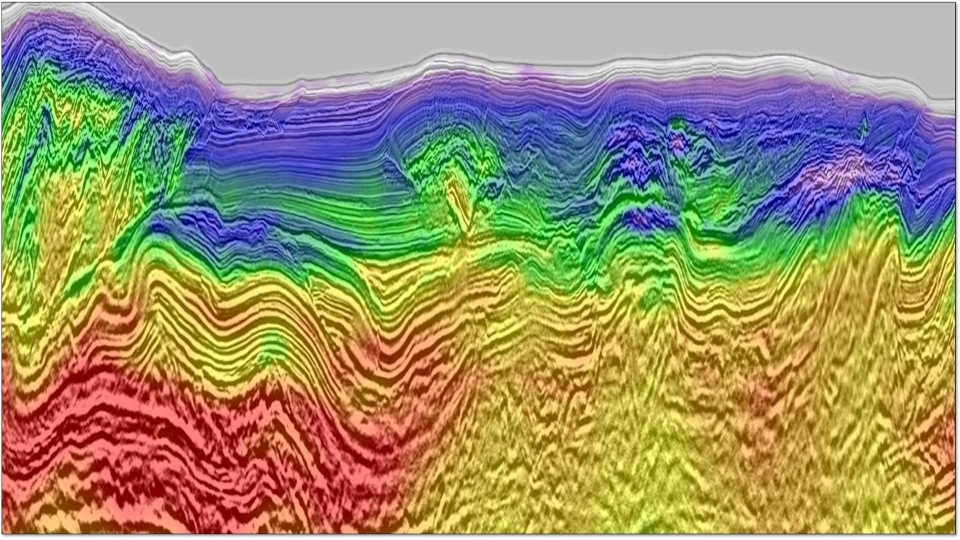

Geoscience: Increased software sales and sustained activity of large and dedicated imaging centers

Multi-client: Solid prefunding rate of 171% in Q4

Equipment: Solid quarter driven by land equipment deliveries - Segment EBITDAs at $118m and Adjusted* Segment EBITDAs at $122m before $(4)m of non-recurring severance costs, a 43% margin

- Segment Operating Income at $(42)m and Adjusted* Segment Operating Income at $17m before $(59)m of non-recurring charges

- Group Net loss at $(100)m including $(61)m non-recurring charges on continuing activities and $(23)m non-recurring charges on discontinued activities

- Group segment backlog at January 1st 2021 stands at $421m

*Adjusted indicators represent supplementary information adjusted for non-recurring charges triggered by economic downturn.

Q4 2020 Conference Call

|

From your computer at: |

From your Mobile or Tablet at:

|

A replay of this conference call will be made available the day after for a period of 12 months via the webcast on the www.cgg.com website.

Please dial 5 to 10 minutes prior to the scheduled start time the following numbers:

| France call-in | +33 (0) 1 70 70 07 81 |

| UK call-in | +44(0) 844 4819 752 |

| Access Code | 2455854 |

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).